- Need Professional CPA?

Tag: COGS Deduction

Texas Gross Receipts Tax Myths (Hint: It’s the Franchise Tax)

Many founders and out-of-state business owners believe Texas has a gross-receipts tax. While technically false, this myth exists because the Texas Franchise Tax – also known as the margin tax – functions similarly by taxing total revenue with limited deductions. Let’s debunk this and explain what Texas actually taxes in 2025. Is There a Gross-Receipts […]

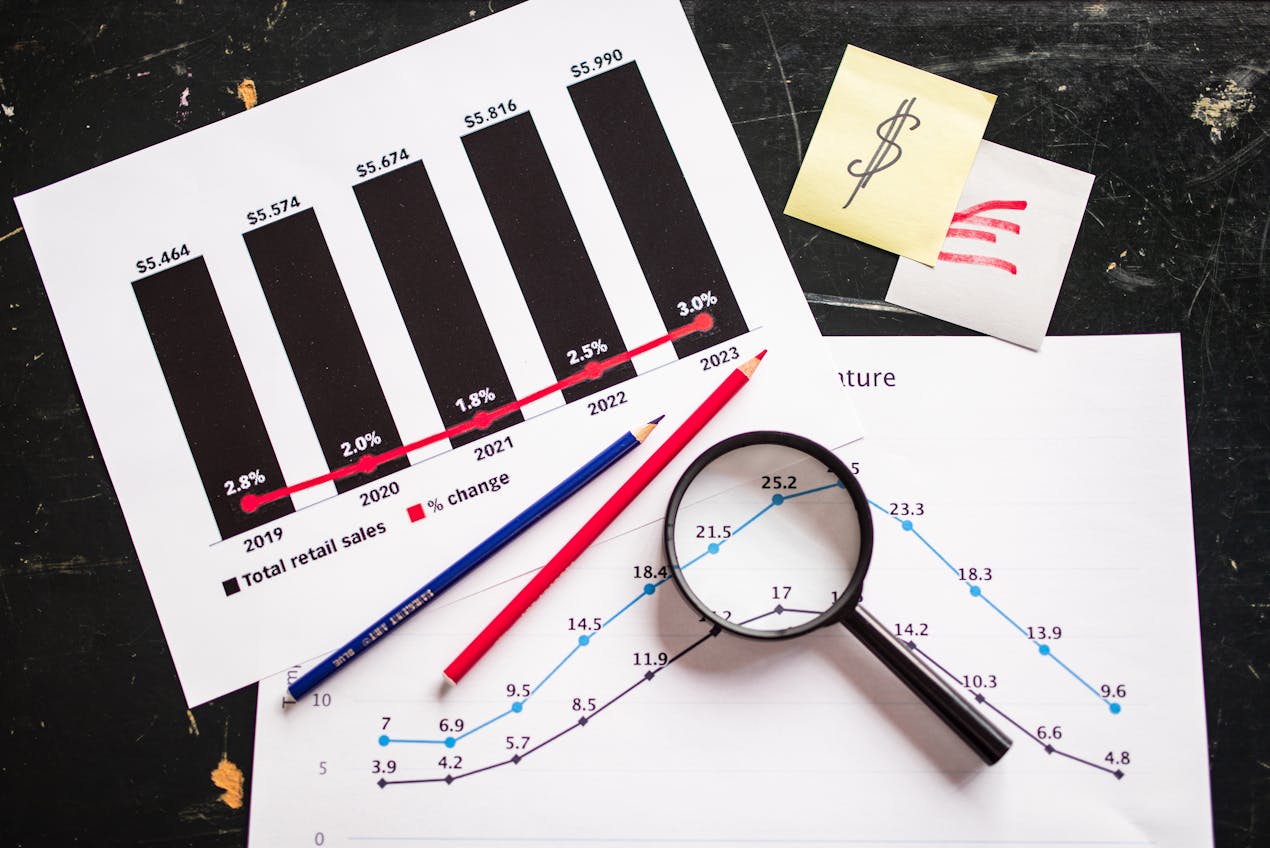

Total Revenue vs. Cost-of-Goods: Picking the Best Texas Margin Method

Total Revenue vs. Cost-of-Goods Texas franchise tax is based on a business’s margin, but there are four distinct ways to calculate it. Choosing the method that minimizes your taxable margin can save you thousands. In this post, we’ll compare: Total Revenue × 70% Total Revenue − Cost-of-Goods Sold (COGS) Total Revenue − Compensation Total Revenue […]

Recent Posts

- Texas Tax Benefits for Online Sellers and E-commerce Entrepreneurs December 29, 2025

- Texas Business Tax Deadlines and Penalties Every Owner Should Know December 27, 2025

- Legal Ways to Reduce Your Texas Business Taxes December 25, 2025

- Texas Franchise Tax Guide: Who Must File And Pay December 23, 2025

- Texas LLC Taxes Explained: Small Business Essentials December 21, 2025